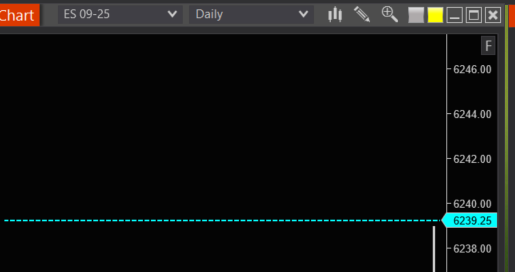

Market Alert: Why 6239.25 Could Be the Ceiling for ES This Month

By Julie Wade, Managing Member – J Auto Trading Strategies, LLC

Hey traders,

The ES futures market is testing a pivotal level—Monthly PT2: 6239.25—and the evidence points to major players like JP Morgan Chase being fully hedged at this mark. This isn’t random; it’s likely a deliberate options and futures risk management wall, and with quarter-end looming, they’re highly motivated to hold the line.

Here’s the Breakdown:

If 10,000 contracts are hedged, each point move equates to ~$3.12 million in notional exposure (at $50 x 6239.25 per contract). That’s a staggering ~$62.4 billion total notional value at this level.

A breakout above 6239.25 would force a costly recalibration of Weekly, Monthly, and Quarterly hedges— a move institutions will fight to avoid, especially today, with Monday being the last full trading day of the month and quarter.

Key Context:

We’re at 68% of the Monthly range—deep into resistance territory.

With Friday’s time pressure, a hedge unwind is a low-probability, high-cost event.

This sets the stage for mean reversion, gamma pinning, or volatility compression. Expect institutional efforts to cap price here. Stay vigilant and position accordingly.

Unlock Daily Insights with JATS PT Monthly Analytics Report

I deliver this level of analysis daily, including:

Institutional hedge thresholds (PT1–PT3 across Daily, Weekly, Monthly, Quarterly)

Dealer gamma flip zones and straddle boundaries

Volatility surface overlays with JATS PT + HALO indicators

Precise setups with stop/target logic for futures and options

Pick up a Premium Subscription on Substack for institutional-grade prep or subscribe to JATS PT Indicator for NinjaTrader separately.

Julie Wade

J Auto Trading Strategies, LLC

Think It 》Trade It 》Automate It

Disclaimer:

J Auto Trading Strategies, LLC ("JATS") is not a registered broker-dealer, investment advisor, or financial planner. The tools, indicators, strategies, and content provided—including but not limited to JATS PT™, V‑SNAV™, and HALO™—are for educational and informational purposes only. Nothing contained herein constitutes a solicitation or recommendation to buy or sell any securities or derivatives. Trading futures, cryptocurrencies, and options involves substantial risk and is not suitable for every investor. Always consult a licensed financial professional before making trading decisions. JATS retains all proprietary rights to its indicators and methodologies. Unauthorized distribution or replication is strictly prohibited.

Risk Disclosure:

Futures, options, and cryptocurrency trading involve substantial risk and are not suitable for every investor. An investor could potentially lose all or more than the initial investment. Only risk capital should be used for trading, and only those with sufficient risk capital should consider trading. Past performance is not necessarily indicative of future results.

Hypothetical Performance Disclosure:

Hypothetical performance results have inherent limitations. Unlike actual performance records, hypothetical results do not represent actual trading and may under- or over-compensate for the impact of certain market factors. No representation is being made that any account will or is likely to achieve profits or losses similar to those shown.

Platform Disclosure:

NinjaTrader® is a registered trademark of NinjaTrader Group, LLC. No NinjaTrader company has any affiliation with the owner, developer, or provider of the products or services described herein, or any interest, ownership, or endorsement in any such product or service.

© 2025 J Auto Trading Strategies, LLC. All Rights Reserved.

JATS PT™, V‑SNAV™, and HALO™ are trademarks of J Auto Trading Strategies, LLC. All content and proprietary methodologies are protected by copyright and may not be reproduced or distributed without express written permission.