JATS PT Analysis: NQ 09-25

Introduction

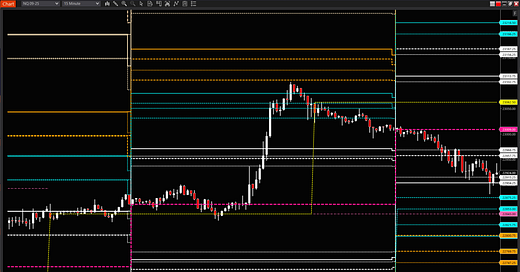

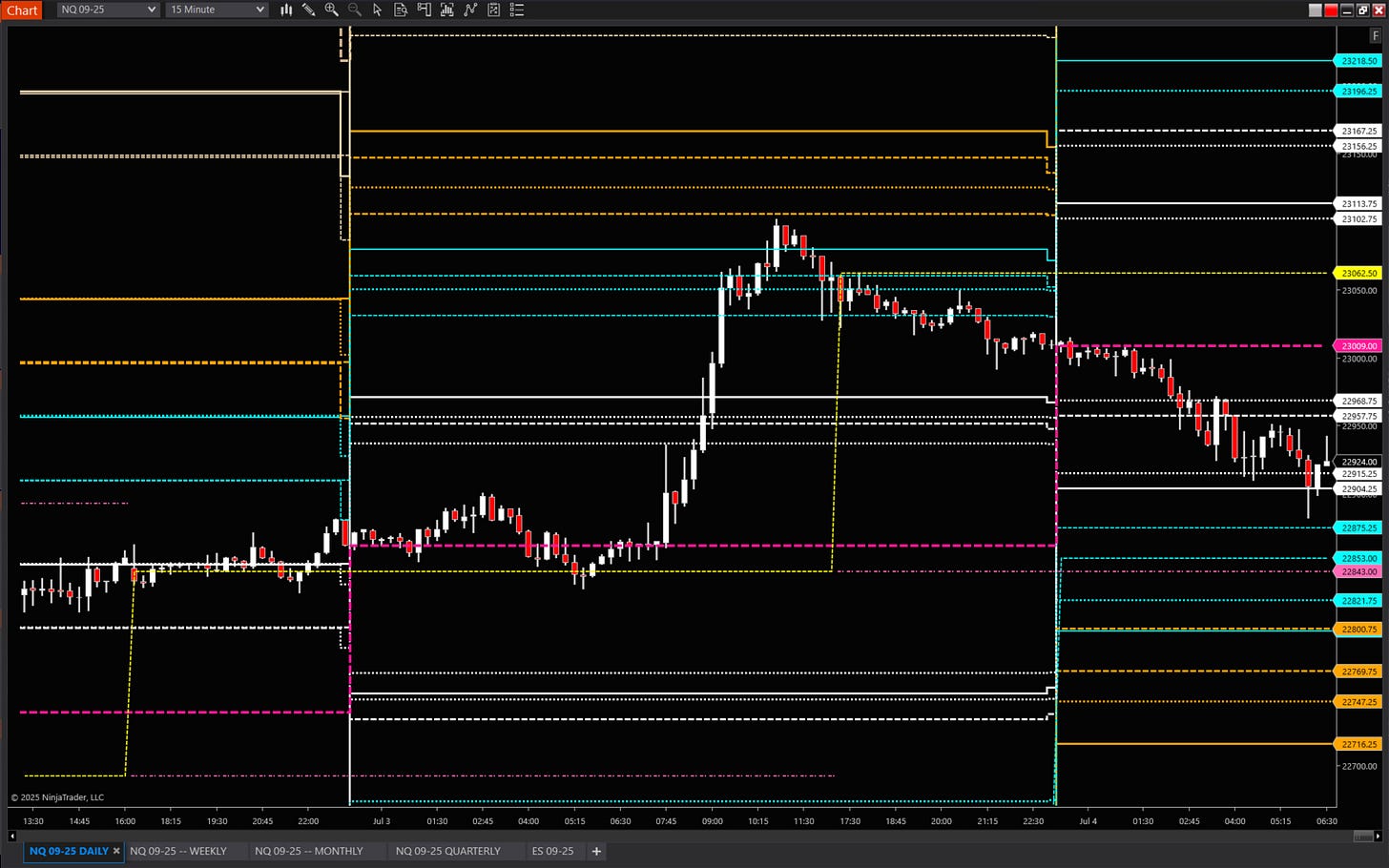

The Nasdaq 100 E-mini (NQ 09-25) powers tech-driven trades, and our JATS PT3 to PT3 analysis, updated with new OHLC data and verified against the chart you provided, charts its course for July 2025. With the market trading at a Close Price of 23,062.50, positioned between the 90-Day 1Aσ Open RVOL at 23,072.00 (Resistance) and the 90-Day 1Aσ Close RVOL at 22,811.00 (Support) as of 07:18 AM EDT on July 04, 2025, we focus on Open and Close prices within 2x the Daily PT3-PT3 RVOL and HVOL ranges to identify key levels across Daily, 7-Day, 30-Day, 90-Day, Monthly, and Quarterly timeframes.

Daily PT3-PT3 Range

Last Price: 22,927.50

Open Price: 23,009.00

Close Price: 23,062.50

Daily PT3: 145.00 (RVOL), 269.50 (HVOL)

2x PT3 Range:

RVOL: [22,637.50, 23,217.50]

HVOL: [22,388.50, 23,466.50]

These ranges define NQ’s expected trading zones, with the chart showing price action near key 90-Day levels.

Timeframe Insights

Daily: The Close Price (23,062.50) is within the 2x RVOL range, aligning with the prior RVOL 1Aσ Open (23,947.25) and Close (23,972.75), signaling stable volatility. The prior HVOL 1Aσ Open (23,564.25) and Close (23,591.25) are within the HVOL range.

7-Day: RVOL’s 1Bσ Open (22,323.50) and HVOL’s 1Bσ Open (22,320.25) are below the RVOL range but within the HVOL range, indicating tighter short-term moves.

30-Day: RVOL’s 1Bσ Open (20,793.00) and HVOL’s 1Bσ Open (21,192.50) are below both ranges, suggesting lower volatility expectations.

90-Day: The 90-Day 1Aσ Open RVOL at 23,072.00 (Resistance) is just above the current Close Price (23,062.50), indicating a critical ceiling, as confirmed by the chart. The 90-Day 1Aσ Close RVOL at 22,811.00 (Support) lies below, providing a strong base. RVOL’s 1Bσ Open (16,754.75) and HVOL’s 1Bσ Open (17,789.75) are well below both ranges, signaling long-term stability.

Monthly: RVOL’s 1Bσ Open (22,338.00) and HVOL’s 1Bσ Open (22,214.75) are within the HVOL range, marking support.

Quarterly: RVOL’s 1Bσ Open (20,739.00) and HVOL’s 1Bσ Open (21,831.75) are below the RVOL range but within the HVOL range.

Cross-Timeframe Trends

NQ’s volatility contracts from a Daily σ spread (~290 RVOL) to ~11,767.50 (90-Day RVOL), but widens to ~11,894.50 (Quarterly RVOL), hinting at tech-driven swings. The 90-Day 1Aσ Open at 23,072.00 and 1Aσ Close at 22,811.00, as shown on the chart, define a significant range, with the current price at 23,062.50 testing the upper boundary. The 1Aσ levels (~23,947–23,972) are consistent within the 2x ranges in Daily and 7-Day timeframes, acting as resistance, while longer timeframes highlight support at 16,754–20,739.

Trading Takeaways

Short-Term: Trade within 22,637.50–23,217.50 (RVOL), with 23,072.00 (90-Day 1Aσ Open RVOL, Resistance) as a key ceiling to watch for a breakout or reversal, and 22,811.00 (90-Day 1Aσ Close RVOL, Support) as a key support for buying dips. The current Close Price (23,062.50) is in a pivotal zone.

Long-Term: Monitor 16,754.75–20,739.00 (90-Day/Quarterly 1Bσ) for major support, ideal for position traders.

Volatility Play: Daily’s RVOL range favors scalping, while HVOL’s 22,388.50–23,466.50 suits swing trades, especially if 23,072.00 breaks or 22,811.00 holds.

Conclusion

NQ 09-25 is trading at 23,062.50, within 22,637.50–23,217.50 (RVOL) and 22,388.50–23,466.50 (HVOL), with 23,072.00 (Resistance) as a critical ceiling and 22,811.00 (Support) as a key base, as confirmed by the chart. The 23,947–23,972 resistance and 22,323 support are also relevant, while long-term traders should target 16,754–20,739 for entries. Stay tuned to tech trends to navigate NQ’s moves today, July 4, 2025.

DAILY

WEEKLY

MONTHLY

QUARTERLY

Disclaimer:

J Auto Trading Strategies, LLC ("JATS") is not a registered broker-dealer, investment advisor, or financial planner. The tools, indicators, strategies, and content provided—including but not limited to JATS PT™, V‑SNAV™, and HALO™—are for educational and informational purposes only. Nothing contained herein constitutes a solicitation or recommendation to buy or sell any securities or derivatives. Trading futures, cryptocurrencies, and options involves substantial risk and is not suitable for every investor. Always consult a licensed financial professional before making trading decisions. JATS retains all proprietary rights to its indicators and methodologies. Unauthorized distribution or replication is strictly prohibited.

Risk Disclosure:

Futures, options, and cryptocurrency trading involve substantial risk and are not suitable for every investor. An investor could potentially lose all or more than the initial investment. Only risk capital should be used for trading, and only those with sufficient risk capital should consider trading. Past performance is not necessarily indicative of future results.

Hypothetical Performance Disclosure:

Hypothetical performance results have inherent limitations. Unlike actual performance records, hypothetical results do not represent actual trading and may under- or over-compensate for the impact of certain market factors. No representation is being made that any account will or is likely to achieve profits or losses similar to those shown.

Platform Disclosure:

NinjaTrader® is a registered trademark of NinjaTrader Group, LLC. No NinjaTrader company has any affiliation with the owner, developer, or provider of the products or services described herein, or any interest, ownership, or endorsement in any such product or service.

© 2025 J Auto Trading Strategies, LLC. All Rights Reserved.

JATS PT™, V‑SNAV™, and HALO™ are trademarks of J Auto Trading Strategies, LLC. All content and proprietary methodologies are protected by copyright and may not be reproduced or distributed without express written permission.