JATS V-SNAV + HALO REPORT – ES 09-25 (S&P 500 E-mini Futures)

Generated: July 7, 2025 | Session: Globex | Instrument: ES 09-25

Welcome

This report presents the JATS Probability Target (PT) framework integrated with options-derived volatility overlays and HALO execution signals. ES is navigating upper compression rails across all volatility bands with July 11 options expiration shaping short-term gamma posture.

Market Overview

Globex Open: 6307.75

Prior Close (Settlement): 6283.50

14-Day Range: 6098.50 – 6296.25

Position in Range: 100% (near ATHs)

Context: High-convexity drift continuation from late June breakout

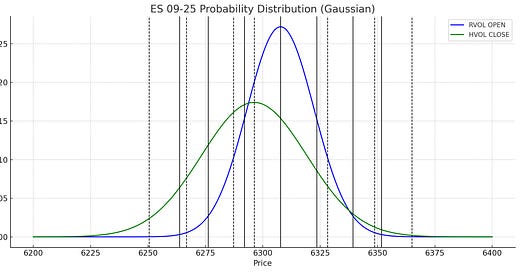

Volatility Regime Context

RVOL Mean (OPEN): 6307.75

HVOL Mean (CLOSE): 6296.25

Price Status: At HVOL mean, slightly below RVOL mean

Realized Compression Band: 6292.00 – 6351.75

HVOL Breakout Level: 6365.00

PT1B Reversion Floor: 6276.25 – 6263.75

ES sits in a tight volatility coil. Despite trading near highs, statistical volatility suggests it is drifting along the upper edge of realized containment. Unless volatility expands or breaks compression, upward continuation may stall.

JATS PT Levels (OPEN and CLOSE)

OPEN-based RVOL Mean = 6307.75

• PT3A: 6351.75 → PT3B: 6263.75

CLOSE-based HVOL Mean = 6296.25

• PT3A: 6365.00 → PT3B: 6250.50

Overlap between 6287.25 and 6328.25 confirms core rebalancing zone. PT3A alignment across both RVOL/HVOL creates an upper barrier of high tail compression.

Options Market Dynamics

ATM Strike: 6300

ATM IV (Call): 16.7%

ATM IV (Put): 21.5%

Put Skew: +6.31%

Implied 1σ Range: ±50.5 pts → 6250 to 6350

Max Pain: 6200.00

Gamma Flip: 5931.09

Straddle volatility aligns with PT3A boundaries. Dealer short gamma risk begins above 6300 and steepens past 6330. Smile structure suggests call-side vanna pressure if ES spikes further.

Price Action Analysis

ES is at the convergence of RVOL and HVOL upper bands. The tape has formed a stallout between 6290–6325, with multiple failed attempts to break 6330. A true breakout above 6351.75 would mark a statistically significant escape, but current convexity does not support the move unless macro catalysts emerge.

Probability Distribution and Inflection Zones

High-density inflection at 6320–6340

Max compression between PT1A and PT2A

Implied breakout trigger: 6365.00

Breakdown trigger: Below 6275.00

Gamma Exposure and Skew

Gamma Flip: 5931.09 (deep below)

Short Gamma Zone: > 6300

Call IV skew steepens from 6325 to 6350

Dealers increasingly exposed above PT3A

Volatility Skew Chart

The skew profile for ES 09-25 shows a pronounced call-side tilt centered around the ATM strike of 6300. VSkew peaks at 0.52 and gradually declines above 6350, indicating that implied volatility is front-loaded into the current compression zone. PSkew remains elevated but slightly flatter, holding near 0.40, consistent with defensive put flow.

Notably, the smile is call-dominant, reflecting dealer hedging behavior and momentum chasing via upside strikes. This reinforces the Tier 1B Reversal Watch condition: as convexity thins and call skew loads near PT3A zones (6330–6365), any upside push may face aggressive dealer resistance and rapid mean reversion.

The skew inflection zone between 6300–6330 now functions as both:

a volatility resonance node (gamma and vanna concentrated)

a potential fade entry zone if smile begins to invert or flatten

This smile curvature confirms the caution warranted by overlapping PT3A targets and IV skew saturation.

HALO Metrics Panel

ΔGEX: ↓ – Dealer convexity decaying

SSR: 1.15 ✅ – Bullish call/put lean

VWOC: ↑ – Aggressive build in call OI

VDI: 0.66 ✅ – Heavy volatility congestion

VCI: 0.20 – Mild compression, not fully coiled

GTI: +0.38 – Positive gamma tilt (upside asymmetry)

DPM: +2.1% – Dealer delta support trending upward

Smile Momentum: Neutral

Strategy Implications

Bias: Bullish Drift with Exhaustion Risk

Preferred Setup: 6335/6350 fade via put spreads or broken-wing flies

Contingency: Bullish confirmation on 6365+ close

Volatility Bias: Slightly long vol into CPI/FOMC window

Macro Overlay

Upcoming CPI print and FOMC tone will control direction. ES is holding under macro silence, but implied volatility suggests dealers remain nervous. Without upside hedging or real flow, the current drift may reverse.

Alternate Scenarios Tracker

🟢 Breakout > 6365 (PT3A HVOL)

Trigger: CPI miss, Fed pivot

Outcome: Rally accelerates to 6390–6410 zone

🟡 Compression between 6280–6340

Trigger: Neutral macro

Outcome: Vol bleed, range traps, gamma coil

🔴 Failure < 6275 (PT1B base)

Trigger: CPI overshoot, yield spike

Outcome: Fast drop to 6240–6200 on convexity unwind

Summary Snapshot

Bias → Bullish Terminal Drift

Max Pain → 6200.00

Gamma Flip → 5931.09

ATM Strike → 6300

Dealer Lean → Short Gamma

Compression Zone → 6292–6351

Strategy → Bearish Reversal Spreads or Neutral Gamma Flies

Tail Extension Protocol

If ES closes > 6365, tail expansion activates toward 6395–6410

If ES closes < 6275, vol gap zone opens to 6240–6200

Volatility Phase Classification (VPC)

→ Expansion Drift Phase

Timeframe Concordance Score

→ High alignment across Daily + Weekly PT structure

Phase Change Alert (PCA)

→ Active. PT3A breach or PT1B rejection will define transition

Pin Density Index (PDI)

→ Moderate pinning at 6300 with loose skew above 6330

Tier 1 Signal Summary

✅ Tier 1B – Reversal Watch (Upper Compression Zone)

• ΔGEX = ↓

• VDI > 0.60 ✅

• SSR = 1.15 ✅

• VWOC = ↑ ✅

→ Bullish pressure exists, but dealer gamma thinning and IV skew warn of high reversal probability above PT3A.

Key Takeaways

• ES is at its statistical limit near PT3A; further upside needs vol expansion or macro ignition

• Dealer gamma profile suggests overhead risk, not support

• July 11 expiration places call wall at 6330–6350; fading these levels offers favorable R/R

• Tier 1B HALO signal confirms high alert for reversal

• CPI/FOMC catalysts will resolve the drift or trigger unwind

Interpretation and Actionable Insights

This is a classic terminal drift zone. Volatility is low, sentiment is euphoric, and dealers are offloading convexity risk at the highs. ES can levitate briefly, but the 6330–6365 zone marks a highly sensitive inflection point. Traders should stay alert to positioning shifts, watch the CPI reaction, and prepare to fade or flip accordingly.

Acronym Legend

• PT1/PT2/PT3: Probability Target Levels

• RVOL/HVOL: Realized vs. Historical Volatility

• VDI: Volatility Density Index

• VCI: Volatility Compression Index

• VWOC: Volume-Weighted Open Interest Change

• ΔGEX: Gamma Exposure Change

• GTI: Gamma Tilt Index

• DPM: Dealer Positioning Momentum

• SSR: Sentiment Skew Ratio

• PCA: Phase Change Alert

• PDI: Pin Density Index

• VPC: Volatility Phase Classification

Disclaimer:

J Auto Trading Strategies, LLC ("JATS") is not a registered broker-dealer, investment advisor, or financial planner. The tools, indicators, strategies, and content provided—including but not limited to JATS PT™, V‑SNAV™, and HALO™—are for educational and informational purposes only. Nothing contained herein constitutes a solicitation or recommendation to buy or sell any securities or derivatives. Trading futures, cryptocurrencies, and options involves substantial risk and is not suitable for every investor. Always consult a licensed financial professional before making trading decisions. JATS retains all proprietary rights to its indicators and methodologies. Unauthorized distribution or replication is strictly prohibited.

Risk Disclosure:

Futures, options, and cryptocurrency trading involve substantial risk and are not suitable for every investor. An investor could potentially lose all or more than the initial investment. Only risk capital should be used for trading, and only those with sufficient risk capital should consider trading. Past performance is not necessarily indicative of future results.

Hypothetical Performance Disclosure:

Hypothetical performance results have inherent limitations. Unlike actual performance records, hypothetical results do not represent actual trading and may under- or over-compensate for the impact of certain market factors. No representation is being made that any account will or is likely to achieve profits or losses similar to those shown.

Platform Disclosure:

NinjaTrader® is a registered trademark of NinjaTrader Group, LLC. No NinjaTrader company has any affiliation with the owner, developer, or provider of the products or services described herein, or any interest, ownership, or endorsement in any such product or service.

© 2025 J Auto Trading Strategies, LLC. All Rights Reserved.

JATS PT™, V‑SNAV™, and HALO™ are trademarks of J Auto Trading Strategies, LLC. All content and proprietary methodologies are protected by copyright and may not be reproduced or distributed without express written permission.